Most of the business advice I read misses a piece of critical information.

You’ll learn about increasing revenue, boosting profit margins, or better marketing tactics.

These are all helpful, but they miss something critical.

You see, at the end of the day, it’s all about customers.

Getting a new customer is one of the keys to success for every company. Your entire team should work toward acquiring and satisfying customers in everything they do.

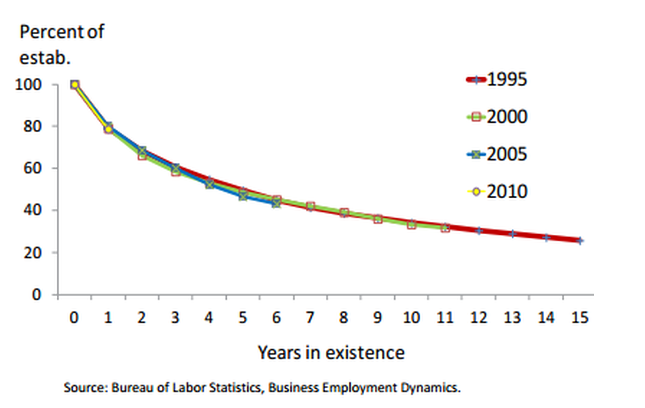

Research shows that most businesses fail in the first five years — a statistic that’s held true for the past 20 years.

Many of those businesses are generating tons of revenue and sales, but without the math on customer acquisition, the costs eventually bring them to their knees.

Why don’t more people focus on this?

Probably because customer acquisition isn’t easy to measure, and it certainly isn’t exciting.

It’s more fun to get tons of new customers, but not as enjoyable to realize that they simply aren’t worth the cost.

And no business wants to turn down eager customers!

So, how do you build a thriving business that drives conversions?

The secret lies in finding and using accurate customer acquisition numbers.

In this article, I’ll present the exact formulas for getting those numbers, and then show you practical ways to improve them.

First, let’s look at what customer acquisition cost is and why it’s important.

How to find your customer acquisition cost

Perhaps the most important part of the entire process is figuring out your total customer acquisition cost, or CAC.

While we could find a few representative buyers and determine the average price to acquire each, that’s not a great strategy.

You’ll inevitably cherry-pick clients who make things look favorable (even if you don’t want to).

We’re human, and we’re almost always too optimistic — especially when it’s about our own businesses.

Instead, you should calculate the CAC for all customers over a specific time period. This will give a more accurate picture. Choose a timeframe of at least a few months.

From there, you can calculate the customer acquisition cost in two ways: a quick method or a more accurate method.

The fastest method for finding your CAC: Just use marketing costs

In this simpler method, we’ll base our calculations off of our marketing costs.

You probably use a few different ad platforms, but most work similarly. In this example, I’ll show you how to find the cost of marketing using Facebook ads.

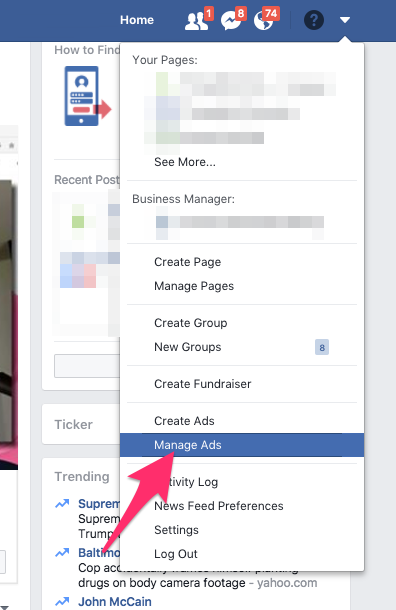

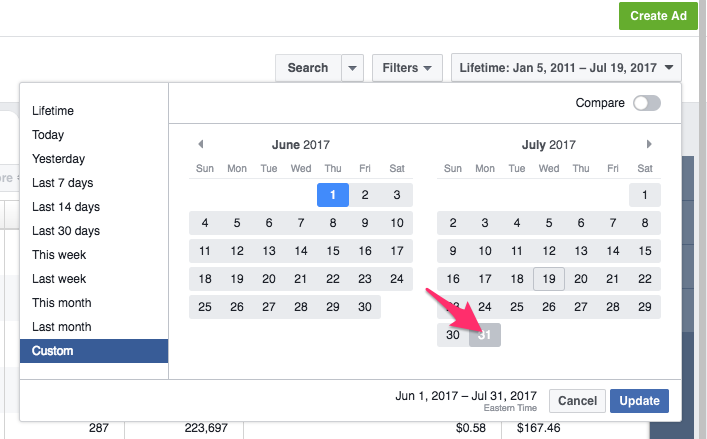

First, log into Facebook and go to the ads manager.

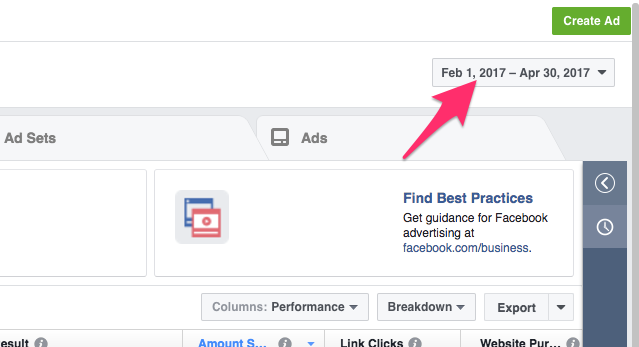

Click on the timeframe button near the top of the page.

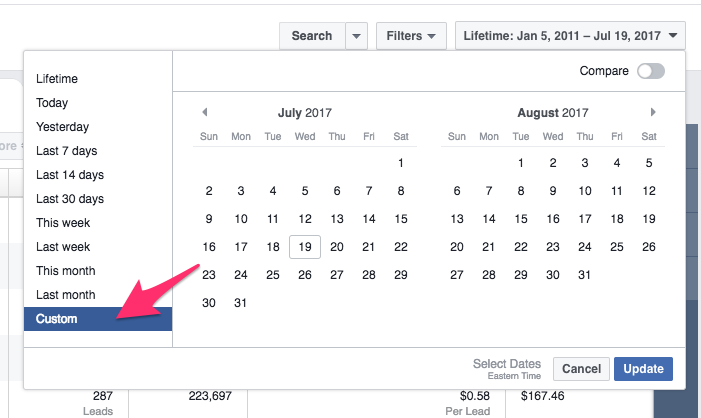

Select the “custom” range.

Click on a start date and end date, and Facebook will automatically select the range between the two.

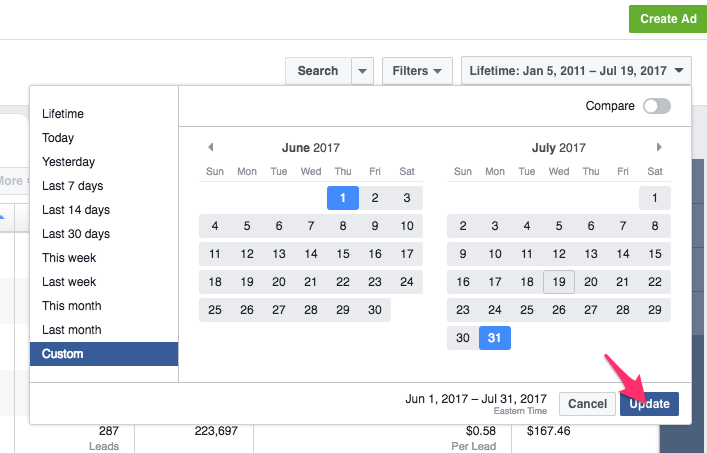

Hit “update” to finish.

Now, you’re going to want to look at the total spending during that time.

If you’re tracking customers on Facebook (I wasn’t for the campaigns I ran during this time), they’ll appear below and can save you tons of time.

Sometimes, you can’t track customers easily with Facebook, so I’ll show a different method in just a minute.

But for now, let’s look at the better method to find total costs.

The best method for finding your CAC: Use all expenses

While you can just use marketing costs, the reality is that you’ve spent more money on customer acquisition. You have to factor in costs like office space, web hosting, software, and your time to get an accurate number.

Marketing, while most closely linked to your CAC, isn’t the only expense.

If you use a program for tracking business expenses, you can easily calculate your costs.

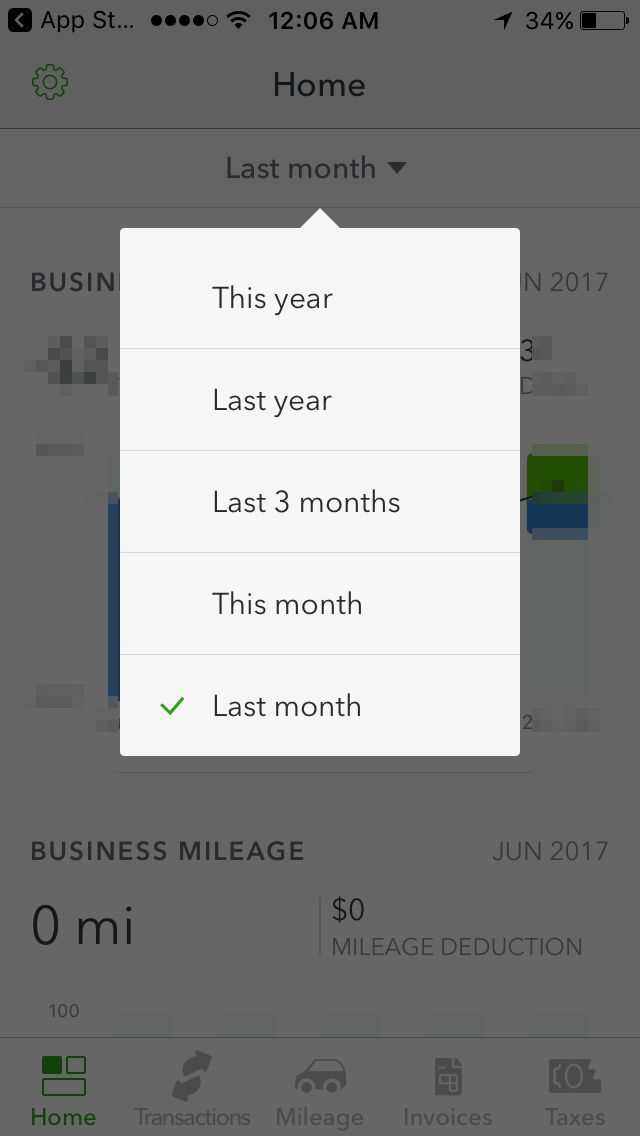

I’ll be using QuickBooks Self-Employed for this example, but again, you can do something similar with any budgeting software.

Unfortunately, the default view doesn’t allow for custom ranges:

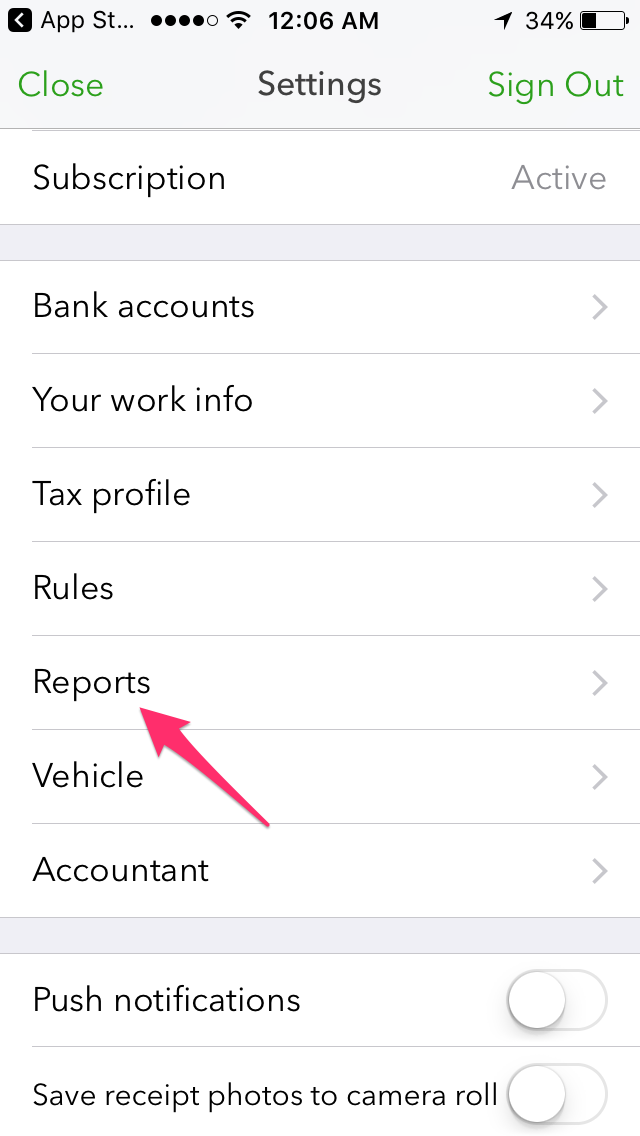

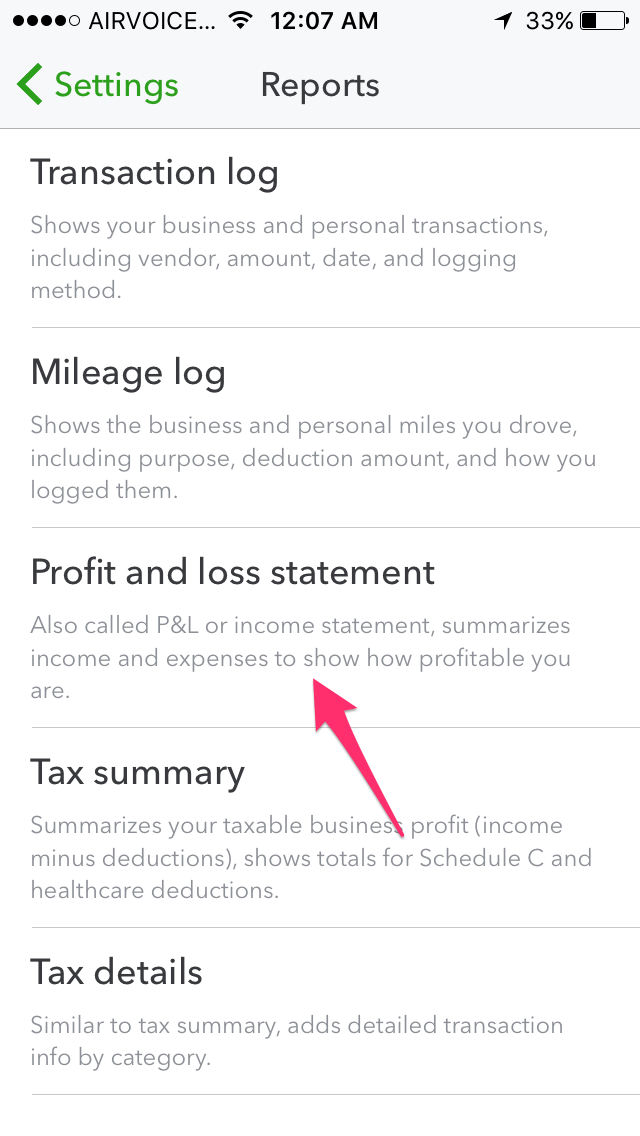

To fix this, click on the gear in the corner, and go to settings. Click on “reports.”

We have a lot of options here, but we want a profit and loss statement. Click on it.

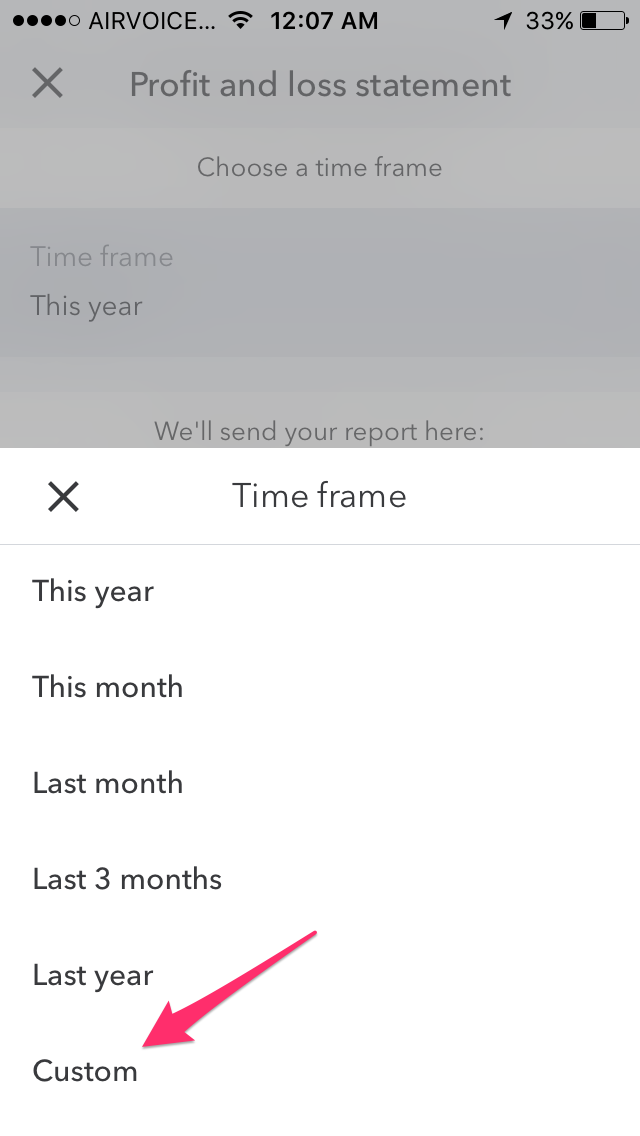

On the timeframe selection, choose “custom.”

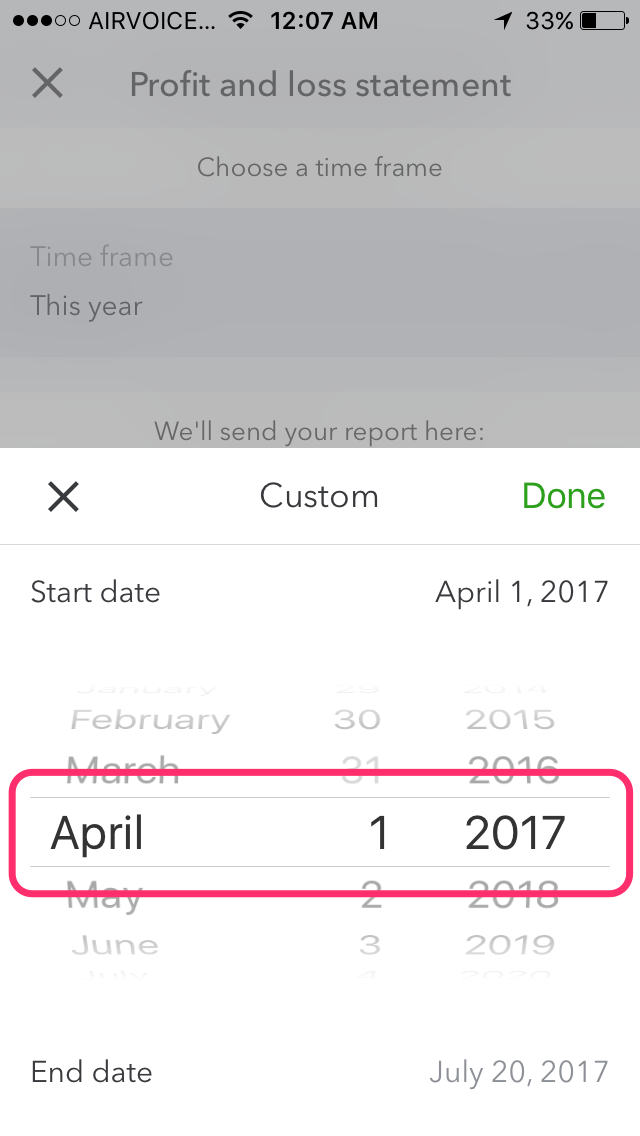

Like before, select your start and end times for the report.

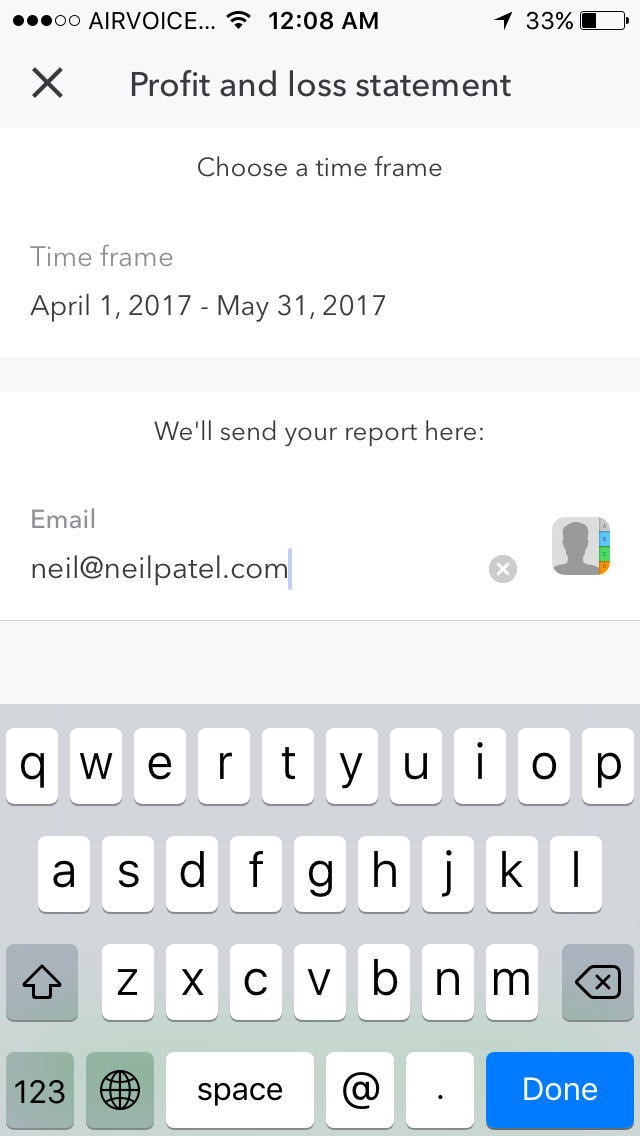

When you finish, type in your email address. It’ll prepare a PDF report to send to you.

In a few minutes, check your inbox for an email like this:

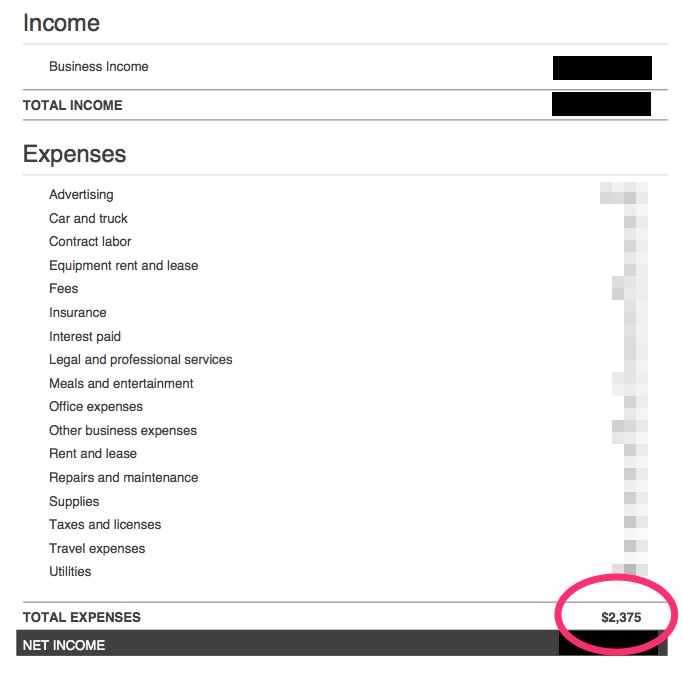

Download the PDF that’s attached. At the bottom of the report, you’ll find “total expenses.”

This number is valuable because it tells you exactly how much you’ve spent during your specified period.

Now you know how much you’ve spent (either just on marketing or on the business in total). To finish the calculation, determine how many customers you acquired during that time.

How to find the number of acquired customers

Depending on how you manage your buyers, you probably have a particular system.

In this article, I’ll be using Stripe, since a lot of business owners manage payments through the program.

First, log in and click on “customers.”

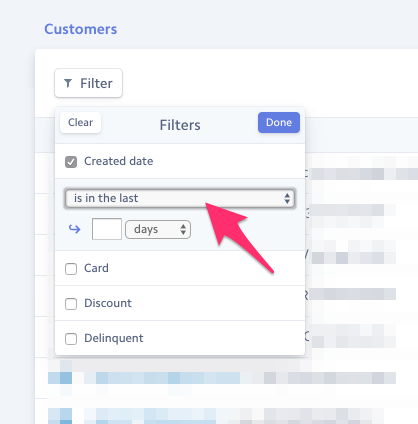

On the customer panel, you’ll see a button to filter. Click this.

Select “created date,” and change the drop-down menu from “is in the last” to “is between.”

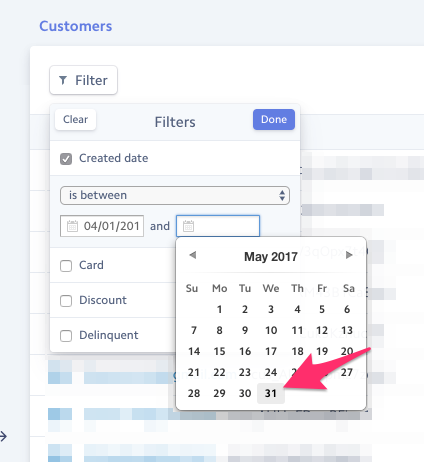

Now enter the date range (use the same timeframe for which you calculated your costs).

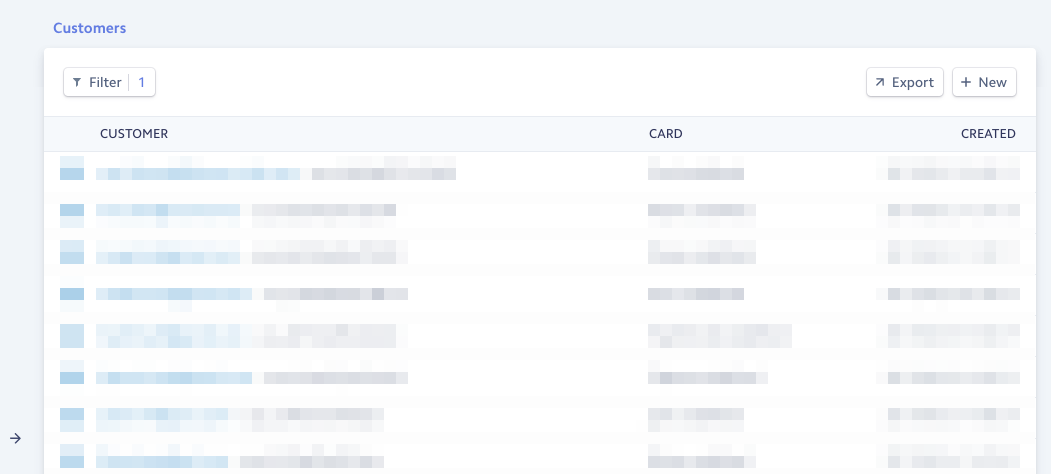

Once you’ve selected that, Stripe will provide you with the total number of customers acquired during your specified range.

The final step: Calculating your customer acquisition cost

Now that you have the total cost during a timeframe and the number of customers acquired in that range, just do some basic math — divide the cost by the customers.

If you spent $1,000 in the last three months and acquired 100 customers, your CAC is $10.

Knowing that number is important, but I know what you’re probably asking yourself: “Is my number a good number?”

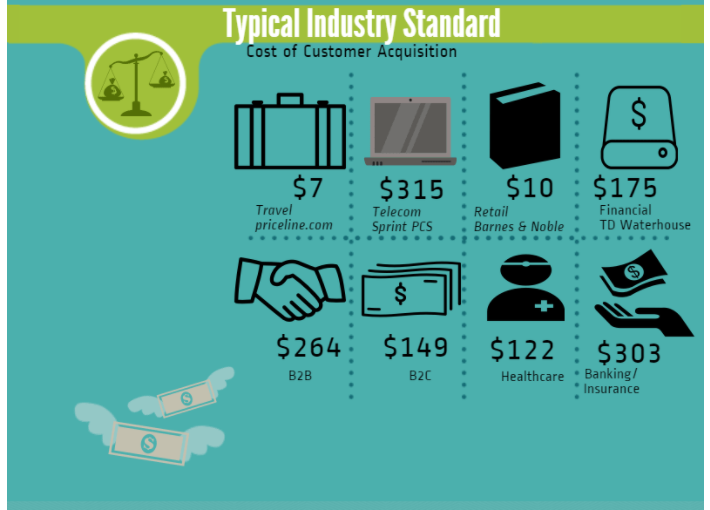

We’ll get to the details in a bit, but here’s a small range of acquisition costs from other industries based on statistics published in Entrepreneur magazine.

You can compare yours, but remember that a “good” or “bad” cost depends far more on your specific goals than on broad industry averages.

Now it’s time to figure out the other part of the equation: How much is a customer worth to you?

How to determine your lifetime customer value

It isn’t enough just to know how much you spend to acquire a buyer.

You also need to know how much each customer is worth to your business.

Why? Because it gives you tremendous power.

Back in 2012, Amazon founder Jeff Bezos shocked the tech world by admitting that Amazon doesn’t make a profit on Kindles.

So, why would the company spend millions developing a product that doesn’t make them money?

Because Amazon knows the total value of each customer and is willing to invest in products to increase that lifespan. In the case of the Kindle, the bet paid off.

According to Bezos, people who buy Kindles read four times more books than they did before investing in Kindles.

Additionally, they don’t stop buying paper books. Kindle owners buy hardbacks, paperbacks, and audio books, too.

The Kindle is, at its heart, a marketing strategy — a strategy that Amazon could only deploy with a solid understanding of a customer’s lifetime value, or LTV.

But shockingly, LTV is out of the reach of most businesses, according to Invesp.

Few understand this number. Let’s change that.

First, calculate the value per billing cycle

If you sell a subscription product or software-as-a-service, it’s easy to calculate the average value of a customer.

Just take each billing cycle — one month, let’s say—and figure out how much the average customer spends.

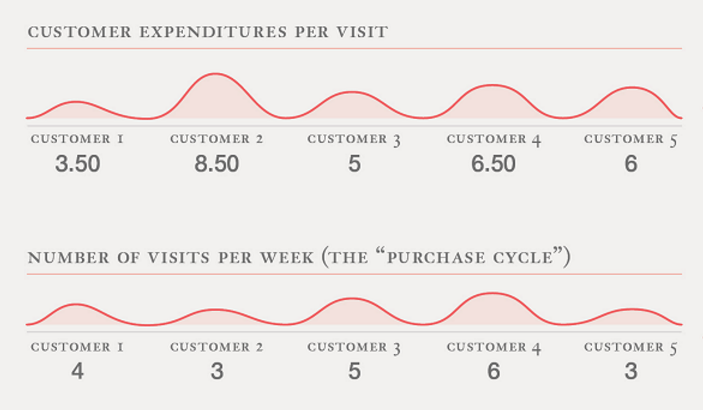

If you don’t bill for a product on a regular basis, the math gets a little trickier. You’ll need to figure out two metrics: the frequency of the purchase cycle and the value of each purchase.

For example, an e-commerce site would calculate the size of each cart and how often customers order.

A company like Starbucks, with multiple purchases per week, calculates it like this, according to an analysis by Kissmetrics.

But there may be other factors at play. Double-check these before making your number final.

Second, account for pricing variables.

Not all customers pay full price.

In fact, some industries make full price such a rarity that it’s an almost meaningless number.

J.C. Penney, for example, makes 99% of its revenue from items sold on sale, and three-fourths of this is marked down 50% or more.

Counting the LTV of a customer based on the ticket price is foolhardy if most purchases are discounted.

Instead, find the real price the customer pays.

Exclude discounts, commissions, and processings fees (the percentage points that go to Stripe or Square or PayPal aren’t yours, so don’t count them).

Now that you know the actual value of one purchase cycle, let’s extrapolate that out to the customer’s lifetime.

Third, establish the lifetime of the customer.

This isn’t literally how long your customer lives.

Instead, it’s the length of time a customer remains loyal to you. This number can be huge — the average customer lifespan of Starbucks is 20 years.

Of course, you won’t find a range like this if you’re just starting (Starbucks couldn’t have known this ten years after opening its doors).

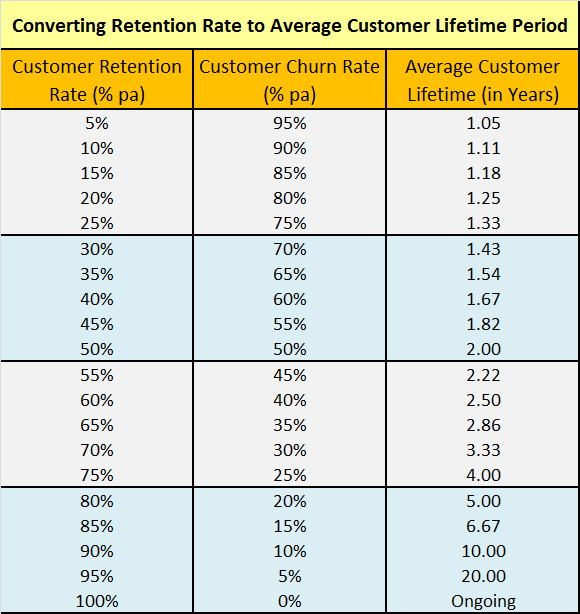

Instead, you can find the annual churn rate — or percentage of lost customers — each year.

Divide 100% by this churn rate. It’s a relatively simple calculation, but this reference chart can make it easier.

As you’ll notice, improvements have a greater effect on lower churn rates.

While cutting churn rate in half from 90% to 45% only brings up customer lifespan by one year, reducing churn from 10% to 5% adds a full decade to the lifespan.

The lesson to be learned is not to be complacent once you have a low churn rate. That’s where you’ll find the biggest rewards.

Once you know the value and frequency of each buying cycle, just multiply it by the customer lifespan.

If your customer spends $20 per month and stays with your company for 2.5 years, he or she has a lifetime value of $600.

Using LTV and CAC

With the numbers you’ve discovered, you can easily find out how well your business is doing.

If you’re spending less to acquire a customer than that customer is worth, all is well! If you can get a new customer for $100, and she spends $150 with you, keep at it.

Of course, the opposite is true. Remember, no matter how small the difference, a CAC that’s lower than the LTV is always problematic.

Spending $100 on a customer who spends $99 over his or her lifetime may seem worthwhile — maybe you can get the customer to spend more? — but it’s rarely a smart move.

If that’s the case with you, the first thing you need to do is to spend less money to acquire each customer.

How to reduce your customer acquisition costs

When most people think of customer acquisition, they think of marketing.

This can be the biggest cost of gaining a new fan, but it also tends to be one that’s difficult to reduce.

If you’re performing frequent split tests and using techniques that work best for your business, you shouldn’t just nix those to save a few dollars.

Instead, you need to find other places to cut costs.

Chances are, you’re spending a lot of money on the purchasing experience.

Your goal should be to “touch” a customer as few times as possible before, during, and after he or she makes a purchase.

But here’s the key: You can’t just eliminate all information. Research from Invesp shows that 83% of shoppers need support to complete a purchase.

That’s a startling statistic because each bit of support adds billable hours and resources to the process.

The secret to saving money with customer acquisition is to automate everything.

Here are four ways to reduce the total cost through automation.

First, explain the product well.

A customer won’t purchase your product without understanding what it does. Your job is to make the features and benefits clear.

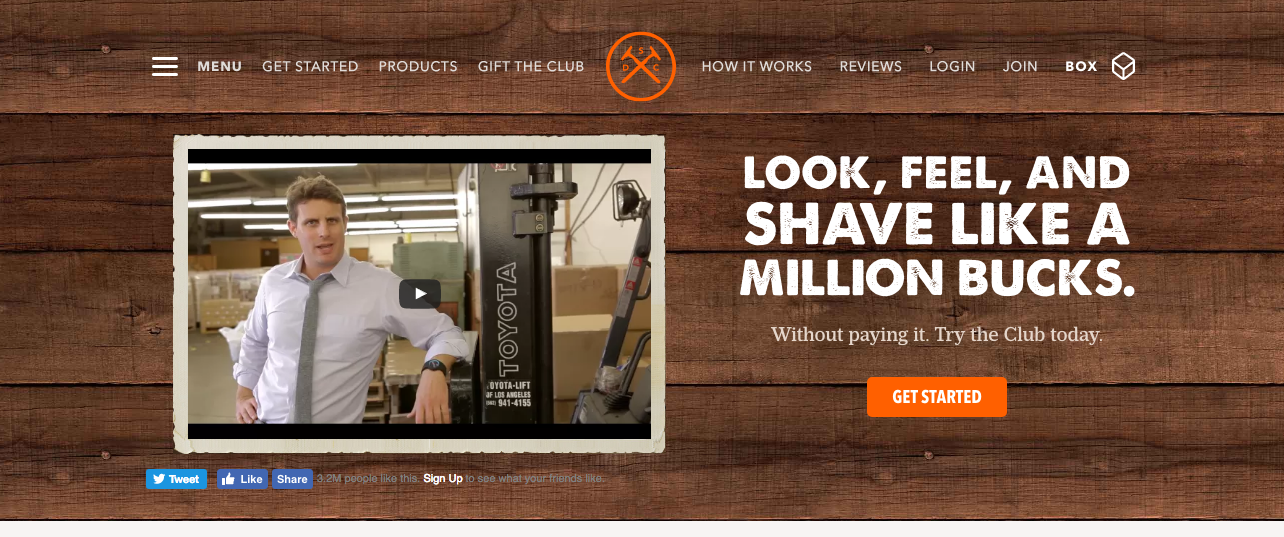

One of the best ways to do this is through a compelling video.

Dollar Shave Club presents its explanation video above the fold on its website.

The company encourages first-time visitors to understand the product (and the company culture behind it) within minutes of visiting the site.

But Dollar Shave Club doesn’t stop there. Underneath the video, you see more details, including images and descriptions.

Customers know exactly what Dollar Shave Club has to offer from the beginning.

Second, answer any and all questions.

Potential customers might have questions outside the scope of a product introduction.

The customers will either give up on the sale or ask the question (and use the time) of a paid employee.

Instead of responding to the same questions again and again, answer them once.

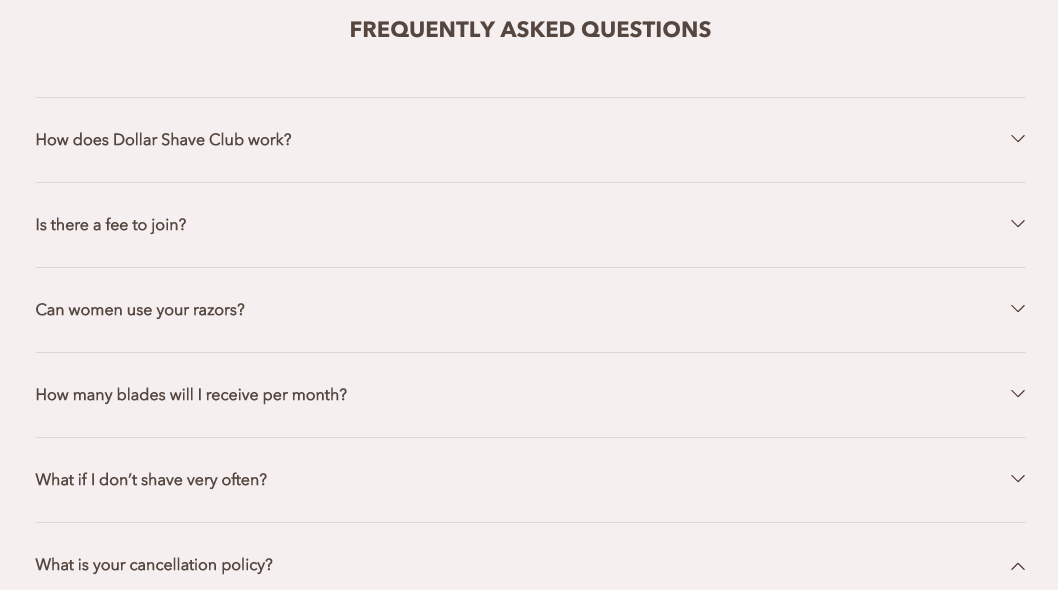

Dollar Shave Club is so direct that it includes a link to the FAQ page underneath the “How it Works” section.

That FAQ page covers pricing and customer concerns.

A few of the questions (“Can women use your razors?” and “What if I don’t shave very often?”) clearly were inspired by customers who asked the same questions over and over.

For more technical products, be sure to provide support documentation.

ConvertKit does a great job of breaking its support articles into categories that make it easy for a confused customer to find the answer to his or her question quickly.

Third, automate your proof.

Perhaps the greatest factor that influences a potential customer is what others have to say about the product.

Often, customers don’t buy because they aren’t sure the product will work for them.

Showing a variety of others who have found success with the product or service can be an excellent way to eliminate those barriers without incurring additional costs.

LendUp provides social proof in a variety of ways on its homepage. The company includes quotes from a diverse range of satisfied customers:

It also shows third-party reviews of its digital courses:

And the website offers an endorsement quote from a well-respected site (TechCrunch):

Finally, show consumers what plan to buy.

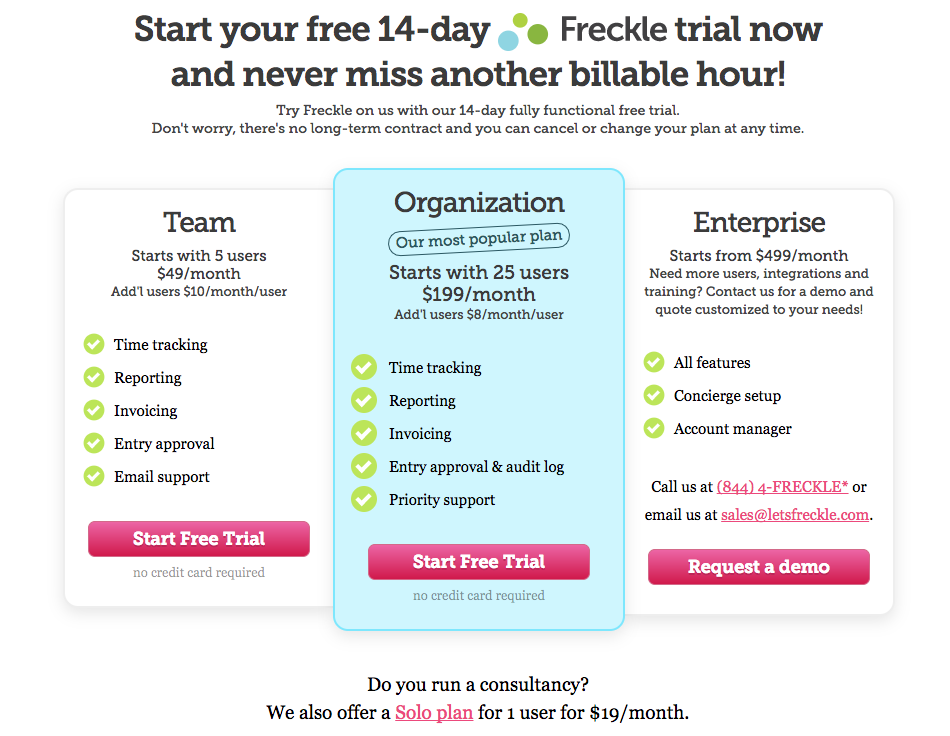

There’s no need to spend time and money teaching a customer what will work best for him or her. Instead, use a comparison matrix to get the point across in a visual way.

Time-tracking app Freckle does a great job by showing exactly what the differences are between each plan.

For customers with larger teams, the company even explains how much each additional user costs.

Below the matrix, Freckle provides a giant checklist of the features in each plan, eliminating the barriers that could be holding back potential customers.

Overall, if you can automate the process required to get a prospect to purchase, you’ll reduce the overall CAC.

But what if you can’t?

If the CAC is impossible to budge, remember that it’s dictated by the value of the customer. As long as your customer has a hefty LTV, you can work with an expensive CAC.

Remember the Starbucks example from earlier?

Let’s say Starbucks spends $1,000 to get one customer to buy one coffee.

It sounds ridiculous — $1,000 for a $5 cup of coffee? But if this fictional cost results in a long-term customer, the expense makes fiscal sense for Starbucks.

You see, a lifetime of $5 coffees adds up:

So if your cost per customer is high, don’t worry. Focus on making that customer worth the price.

How to increase the lifetime value of each customer

The simple truth is that increasing the value of each customer has a huge return on investment.

According to executive strategist and thought leader Jay Abraham, there are three ways to increase the profit of a business.

You can increase the number of customers, increase the value of each sale, or increase the frequency of sales.

First, increase the number of customers.

Believe it or not, you can increase the number of buyers without acquiring any new clients.

The solution? Increase retention rates.

If you’re gaining and losing customers at the same speed, and you suddenly retain customers an extra few months or years, you’ll grow at unprecedented speed.

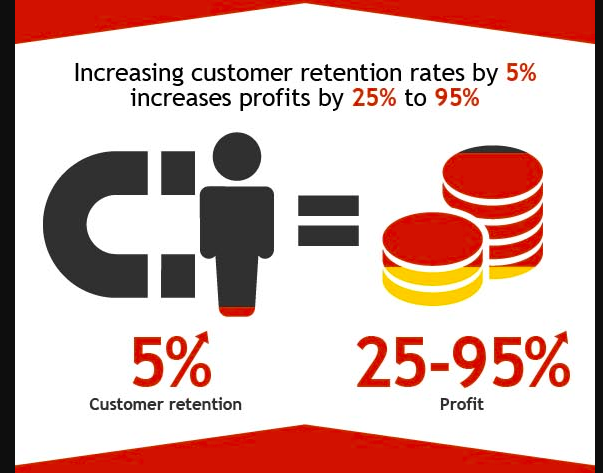

Just looking at one of the factors — retention — can completely change a company’s profit margin. Keeping a customer on for an extra year or more can grow income exponentially

Research shows that increasing customer retention rates by 5% increases profits by 25-95%.

I’ve written on some specific retention strategies before. In that article, I explained that two of the best ways are to improve the customer experience and to build relationships.

By consistently making customers happy and learning what improvements they’d like to see, you can skyrocket your retention rates.

At their core, people want to feel heard and understood. Once they do, they’ll stay loyal to your business for years.

Second, increase the value of each sale.

To increase the lifetime value of each customer, try to increase the value of each sale.

This is why fast food chains offer a drink and fries with each order. The small upsell adds up over the course of multiple purchases.

There are plenty of psychological principles you can use to increase the value of each sale.

One way to do this is to add an even more premium product to your lineup. Research has shown that customers will spend more if there’s a more expensive product available.

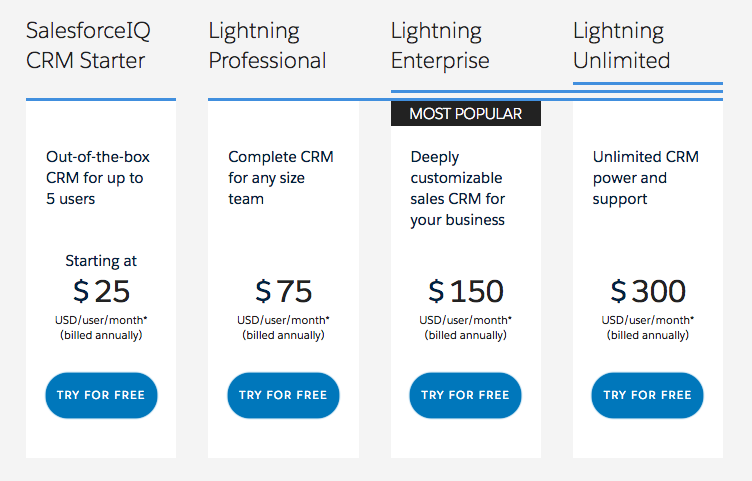

Salesforce does a great job of anchoring its pricing to a $300/month plan.

Teams that only need the $75/month plan might upgrade to the $150/month tier since it has extra features — but still isn’t the most expensive option.

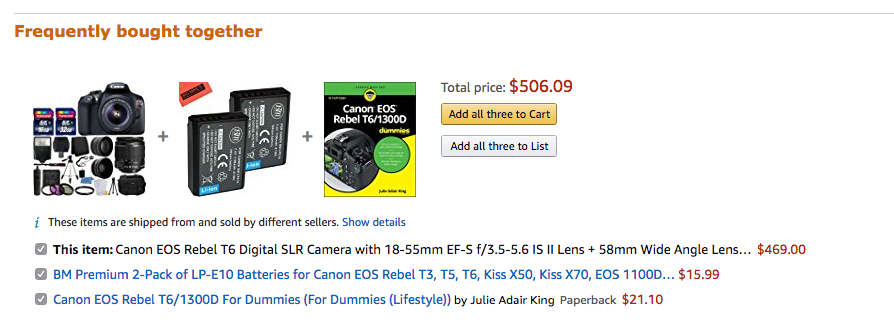

Amazon takes a tactic similar to the fast food chain upsize with its “frequently bought together” feature.

The site recommends small additional, complementary purchases. Whatever you sell, you can almost certainly find an additional product that will increase the value of each sale.

Finally, increase the frequency of purchases.

Chances are, your original product line has limitations in its customer base.

Perhaps you only appeal to beginners and lose buyers as those beginners learn new skills.

Maybe your product only appeals to a small target market but could be expanded.

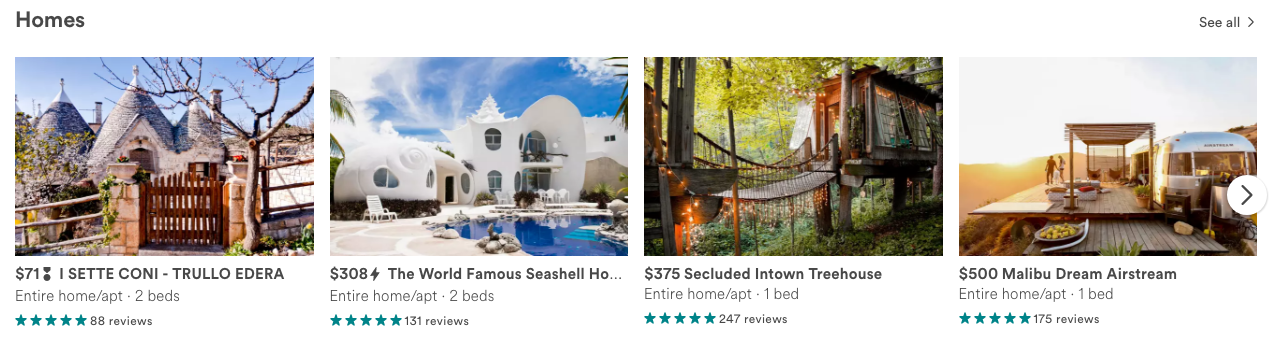

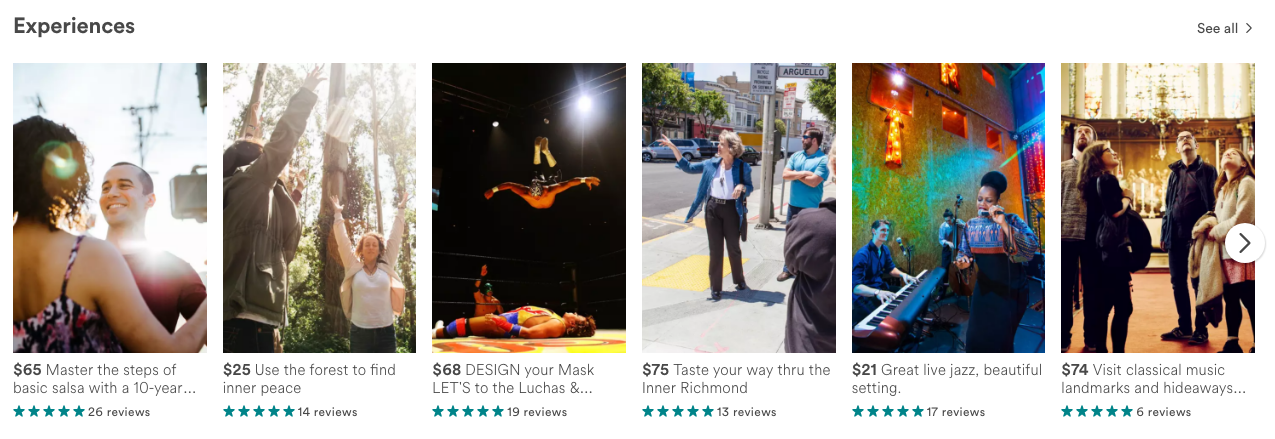

Until recently, Airbnb was just a platform for staying in someone else’s home. This worked well for customers who were traveling out of town and didn’t want to stay in hotels.

In 2016, however, the company expanded its offerings to include “experiences” — activities to do in a particular location.

This allows Airbnb customers to purchase more frequently.

You might buy an experience in your hometown, or in a destination where you’re staying with friends or relatives. Airbnb has provided more reasons to purchase through its website.

Another critical way to increase purchases is through constant communication, especially via email.

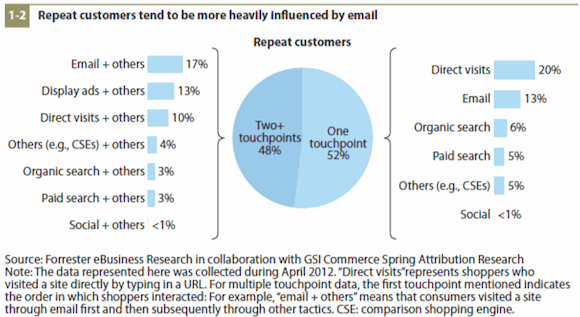

Research in a Forrester report shows that email is the biggest factor affecting purchase decisions in repeat customers.

Don’t be afraid to remind customers about buying again.

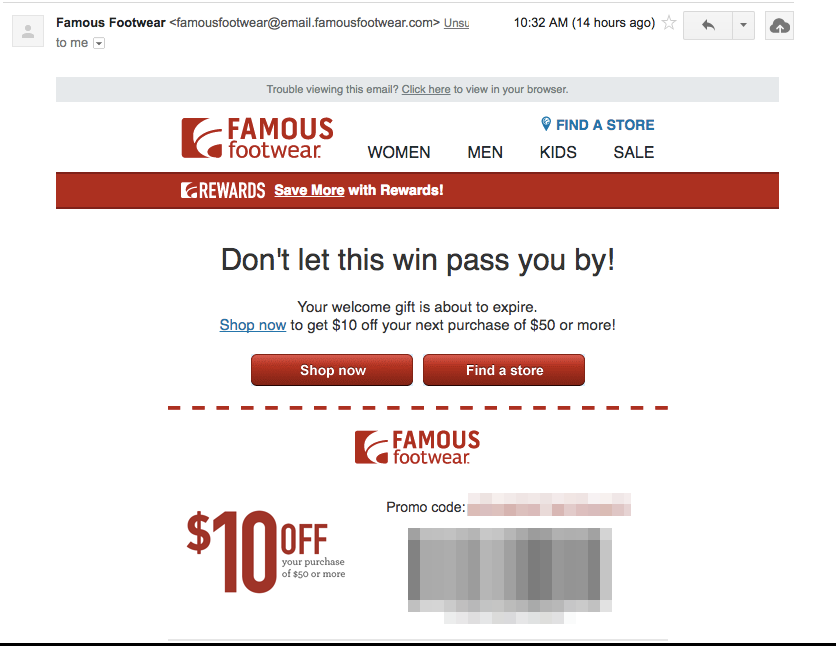

Famous Footwear shares a time-sensitive coupon with buyers, then follows up via email if the consumer doesn’t use it within a week.

Using constant communication can increase the number of sales and the overall lifetime value of the customer.

Overall, smart marketing can allow you to maximize a buyer’s LTV and bring in maximum profits.

Conclusion

Building a sustainable business isn’t complicated if you know the right numbers.

Handling the math of customer acquisition is the cornerstone of success.

With a solid knowledge of your customer’s lifetime value, you can build elaborate marketing campaigns to target your most valuable clients.

You can make sure that no matter how much money you spend to acquire a customer, or how little a customer appears to be worth, the important factor is in the comparison between the two.

Remember that customers aren’t always valuable, and more customers (if they’re too expensive to retain) can do your business more harm than good.

By knowing your exact statistics and numbers, you can build a thriving business that continues to acquire valuable customers and provide real value to them.

Know how much a new customer is worth, know how much it costs to acquire that customer, and you’ll be golden.

With those numbers in mind, you have all kinds of freedom to expand into new markets, test new strategies, and even experiment with new products.

By increasing the lifetime value of each customer, you can skyrocket your profits, increase your marketing costs to find new customers or both.

By decreasing the cost of acquisition, you can find new customers and build a tribe of raving fans for pennies.

Either way, it’s dependant on knowing what you’re working with and being unafraid to use those numbers to your advantage.

A few simple numbers can mean the difference between a company that falters with negative revenue and one that beats the statistics and lasts for decades.

How will your marketing improve by calculating your customer acquisition cost?

Comments (6)